This article has been prepared by WorkTime. We are non-invasive and safe productivity monitoring software with 20+ years of experience in the industry.

How does overtime fraud happen?

Employees abuse overtime in different ways. The most common payroll fraud happens when employees falsely increase their charges by manipulating overtime hours.- Logging hours beyond actual work time - employees falsify timesheets by claiming overtime for unworked hours;

- Clocking in earlier or clocking out later than the actual work started/ended;

- Exaggerating the time needed for a task. Extra workload requires an extra charge. So, an employee can record extra hours to finish a basic task to earn a higher pay rate because of its complexity.

Overtime rates often pay time-and-a-half or more.Why is overtime fraud a problem? It can be costly for businesses, as overtime rates often pay time-and-a-half or more. Without proper employee overtime tracking and accurate timesheets, the company risks losing huge sums of money.

Why are employers so concerned about overtime fraud?

Fraud overtime claims lead to significant losses, as companies end up paying for hours employees did not actually work. Still, it is not the worst outcome.Overcharging for unauthorized overtime, trials & auditing procedures, and potential reputational damage are the major risks of overtime fraud.

Boston Police overtime fraud scheme

The Boston Police Department's overtime fraud case remains a hot topic of discussion in the media. The court proceeding revealed that the former sergeant personally collected $25,930 from federal funds for overtime hours he did not work. Over a dozen police officers were involved in this payroll fraud scandal. The trial is still ongoing.DoD payroll fraud cases

The Department of Defense agency hired external auditors to find the cause of excessive amounts of overtime compensation for remote employees. The payroll audit revealed overtime fraud, as some employees claimed up to 190 unauthorized hours per pay period. The absence of proper employee overtime monitoring resulted in approving timesheets without review due to the remote location. Another Department of Defense audit uncovered three employees falsifying overtime on a regular basis. It cost the federal government over $35,000 for each. Unfair employees took advantage of poor control over timesheets, as their supervisor was overloaded, failing to manage overtime accurately.M.T.A. overtime abuse under federal inquiry

The federal prosecutor’s investigation of Long Island Rail Road (LIRR) employees confirmed suspicions of overtime fraud. One worker earned $461,646 by claiming substantial weekly overtime hours. The inquiry spotlighted LIRR’s outdated, handwritten timekeeping system that led to high overtime payments and payroll fraud.The absence of proper overtime tracking creates opportunities for fraud.In all these incidents, insufficient overtime monitoring was the main cause of overtime fraud. That’s why accurate timesheets are the first step to prevent outcomes.

3 ways you lose money from overtime fraud

1. Paying for overtime fraud

Overtime fraud may happen when employees exaggerate the hours worked. It includes submitting false timesheets, taking extended breaks without deducting time, or clocking in/ clocking out early/later than employees actually start/finish work. This kind of time theft is the most common among work-from-home employees. Poor overtime tracking in this case leads to significant money losses.2. Paying remote employees for unauthorized overtime

Working from home is a normal practice nowadays. Most employees prefer to stay remote, making it challenging for employers to manage them effectively. Employees are often easily distracted at home. Thus, frequent breaks often lead to overtime because workers need more time to complete the same amount of work they could do in the office. It’s hard to clarify whether extra hours were justified or not when working remotely. That’s why employers often overpay for underperformance without accurate overtime monitoring.3. Fines, penalties & other legal outcomes

Poor employee overtime tracking leads to inaccurate overtime compensation, as it’s hard to ensure all employees are properly compensated. Thus, an employer undergoes financial losses because of overpayment and legal risks in case of overtime underpayment, as it violates labor regulations. As a result, the company can come across fines, penalties, and other legal outcomes.$7,500 per employee saved annually thanks to WorkTime overtime monitoring.WorkTime successfully cuts overcharges. Thanks to our overtime monitoring, one of our clients saved $7,500 per employee annually. This sum was usually paid to remote workers for unauthorized hours they claimed as overtime.

Overtime fraud is more frequent than you think!

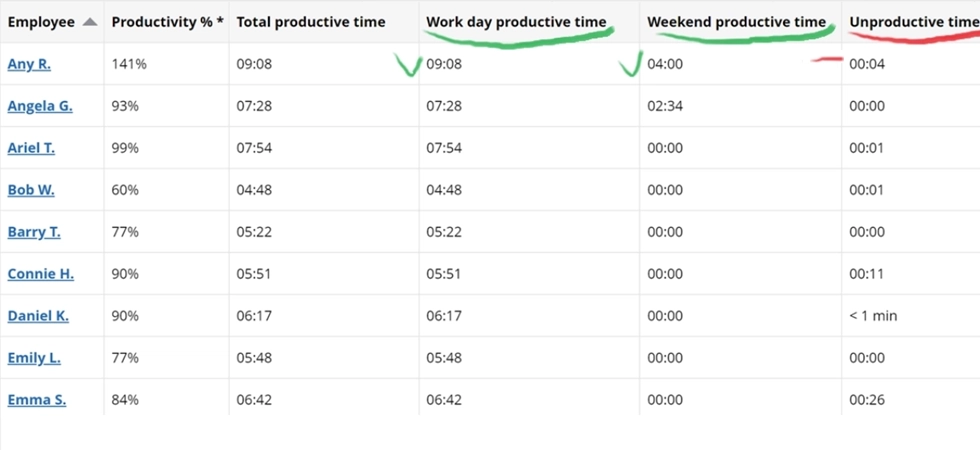

According to statistics, “an average US company loses 20% of every earned dollar due to a time theft.” The majority of companies face this problem at least once. The situation started to get worse during the COVID-19 pandemic when a large number of employees worked remotely. As working from home remains a trend till now, the same relates to a time theft problem.About 10% of overtime claims are justified - WorkTime overtime tracking findings.One of our clients, the US insurance company, implemented WorkTime employee overtime tracking to investigate why employees claim overtime too frequently. The results were shocking, as overtime monitoring showed that only 10% of the claims were justified. The company’s management revealed that about 70% of computers were used for work-unrelated purposes such as social networking or online shopping, and about 5% did not work at all during claimed overtime. We regularly received clients' requests to include specific data related to overtime in the report. Employees frequently claim extra hours during weekends or days off. However, it does not guarantee they were productive during this period. Many employers are concerned about overtime fraud and want to ensure that extra hours are justified. That’s why we enhanced the report’s functionality, allowing employers to evaluate total productive hours claimed as overtime.

This report provides a brief overview of a particular employee's performance metrics, including productivity, active time, and attendance. You can quickly estimate the selected employee and ensure that his/her overtime was justified.

Start free trialOvertime tracking prevents overtime fraud

Unmanaged overtime leads to low productivity, excessive absenteeism, and burnout. Prevent it effortlessly with WorkTime!In addition to potential money loss risks, overtime fraud has numerous negative effects in the long run. Increased absenteeism, low productivity, and burnout are the key issues affecting overall performance. Still, proper overtime management is the first step to preventing overtime fraud. With WorkTime, you can optimize overtime accounting and prevent payroll fraud. How to benefit from our overtime monitoring?

- Take advantage of automated tracking of overtime hours;

- Get accurate timesheets for each employee;

- Ensure that claimed hours are valid. Our reports evaluate employee productivity during weekends, days off, and extra work hours;

- Stay sure your remote workers are active during overtime hours;

- Optimize overtime payments. Accurate overtime tracking prevents overcharging for abused overtime;

- Balance the workload and decrease overtime cases with our data-driven insights;

- Stay transparent with our green employee monitoring approach. WorkTime is safe and non-invasive, so you can monitor overtime in a loyal and business-oriented manner.